Instructions on Margin Buying Power Trading Service – EzMargin Pro

1. Introduction

- Buying power margin trading (hereinafter referred to as EzMargin Pro) is a securities transaction of customers using a loan borrowed from FPT Securities Joint Stock Company (FPTS) and secured by collateralized securities and other assets of customers hereof.

- EzMargin Pro features:

- Customers are allowed to buy shares on margin within their buying power and remaining limits. Buying power is automatically calculated by the system and updated to the system for customers.

- Secured assets for EzMargin Pro are all the cash available, cash pending for payment and securities available in the account.

- The system will automatically disburse loans or collect debts at the end of the day.

- To use the EzMargin Pro Service, please go to FPTS Head Office, Branches and Transaction Offices to sign the EzMargin Pro Agreement with FPTS. Customers must not have outstanding debts in ordinary margin loans (EzMargin/EzMortgage), if any.

2. Instruction on EzMargin Pro

2.1. Eligible margin list

- The eligible margin list consists of marginable securities with given ratios.

- The list may be updated and changed by FPTS from time to time.

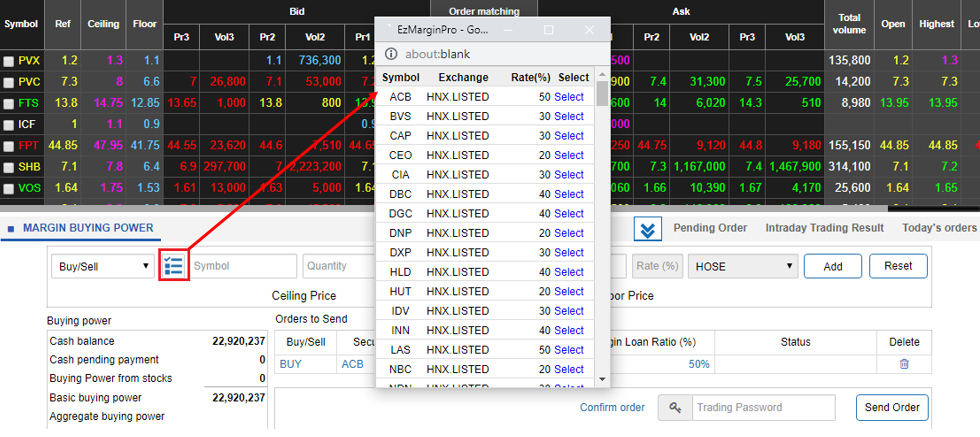

- To search the eligible margin list, please click on the icon  on the order-placing screen

on the order-placing screen

2.2. Margin trading limit

- To use the margin trading service, customers will be granted margin trading limits by FPTS.

- The margin trading limit is the maximum value that customers can borrow for margin trading from FPTS.

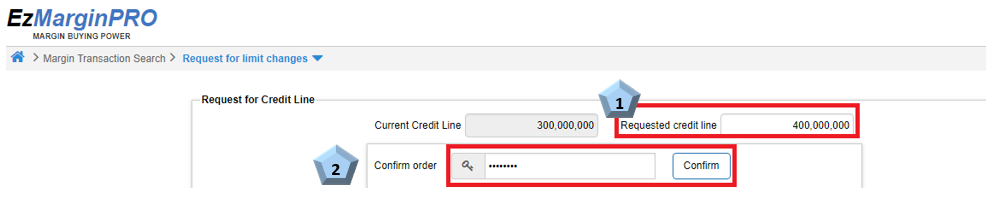

- In case they use up their limit, they can “Request for margin limit changes.”

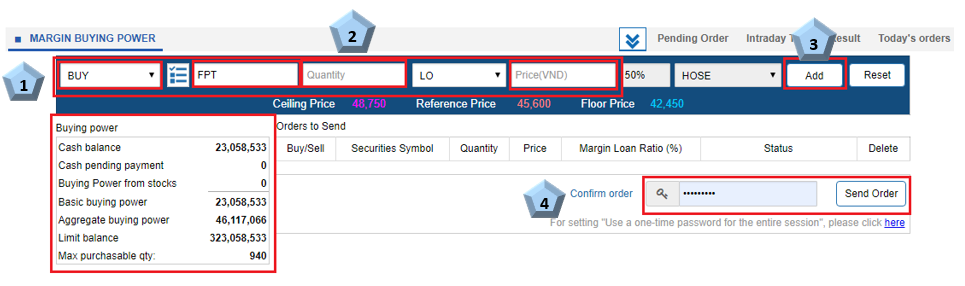

2.3. Placing a buying/selling order

- The steps to place a margin buying/selling order is the same as the steps to place an order to buy/sell ordinary shares.

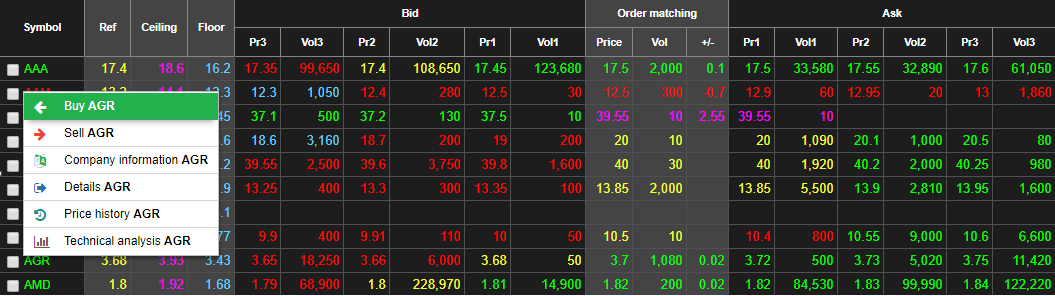

- Method 1: Placing an order from Market Watch

- Step 1: Right-click on the selected stock symbol and then select “Buy” or “Sell” on the price board. The order-placing screen will automatically fill the following information.

- Buying/selling order

- Securities symbol

- The autofill price will be the best buying price (for a selling order) and the best selling price (for a buying order).

- Step 2: Enter the quantity of shares, change the price (if necessary) and click “Add” and enter the trading password to “Send Order.”

- Method 2: Placing an order from the Order-placing screen.

- Step 1: Navigate to the “Order-placing” tab.

- Step 2: Fill in the order information. The system displays information about cash balance, buying power, limit and other indicators to support customers through order placement.

- Step 3: Add the order placed to the “Pending Order” list. Multiple orders can be added to the Pending Order list before they are sent to the system.

- Step 4: Enter the trading password and Send Order.

2.4. Cancelling/Modifying Order

To cancel/modify an order placed, please navigate to the “Orders to trade” tab. Steps of order cancellation/modification are the same as steps applied to ordinary orders. Please see here.

3. Online Reports

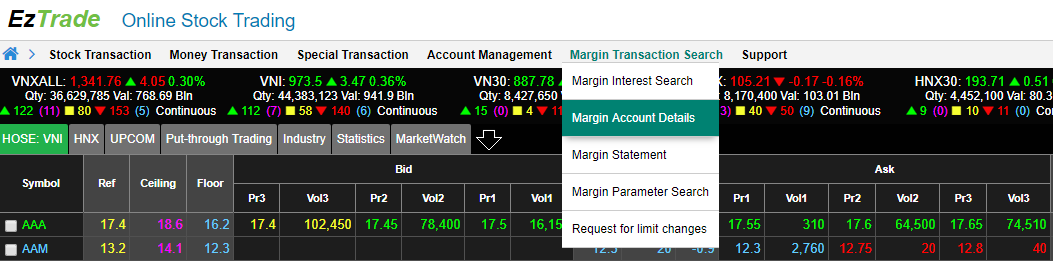

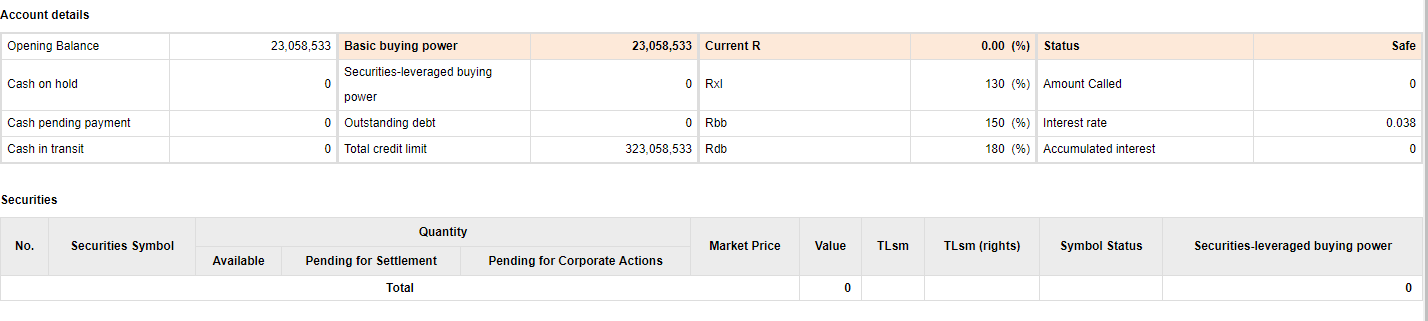

3.1. Looking up margin account details

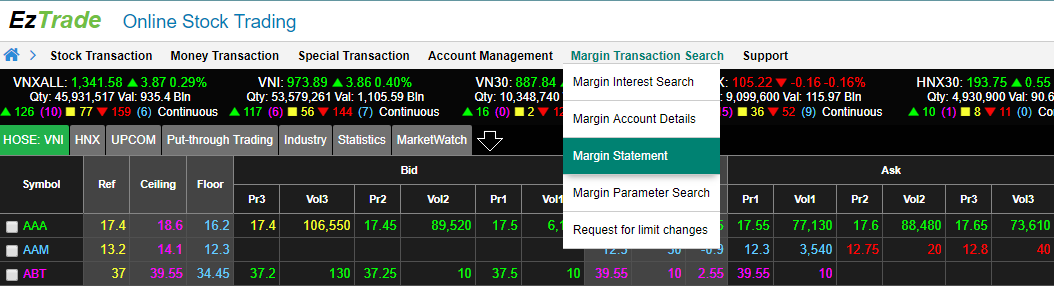

To check margin account details, click “Margin Transaction Search” tab and select “Margin Account Details” item

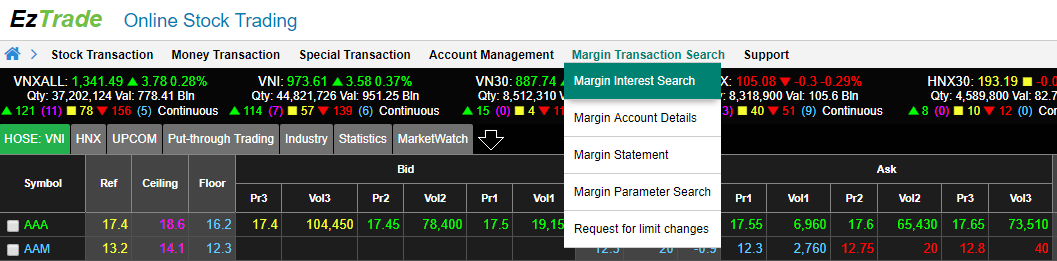

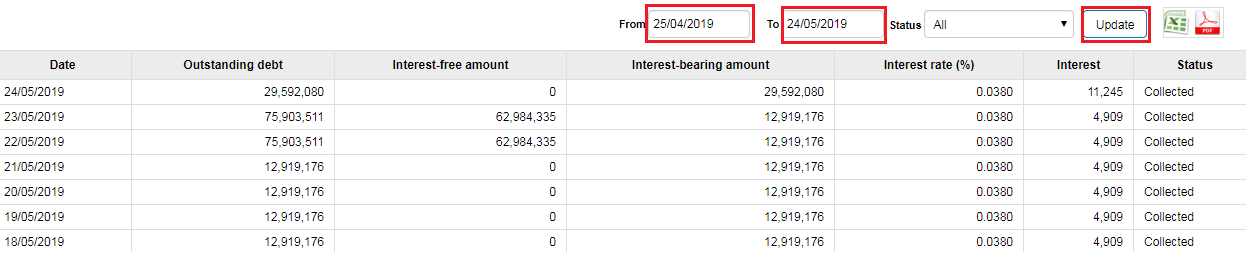

3.2. Margin interest search

- To look up the details of transactions on margin, please navigate to “Margin Transaction Search” tab and then “Margin Interest Search” item.

- After selecting parameters (time span, interest date status, etc.), please click “Update” button to view descriptions.

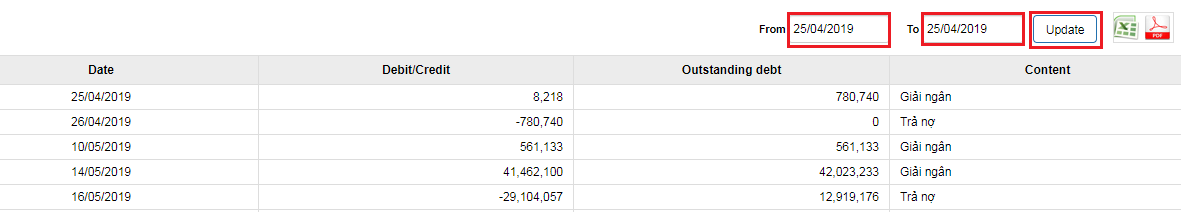

3.3. Margin statement

- To look up margin loans, please navigate to “Margin Transaction Search” tab and then “Margin Statement” item.

- Choose the time period and then click “Update” to view the report.

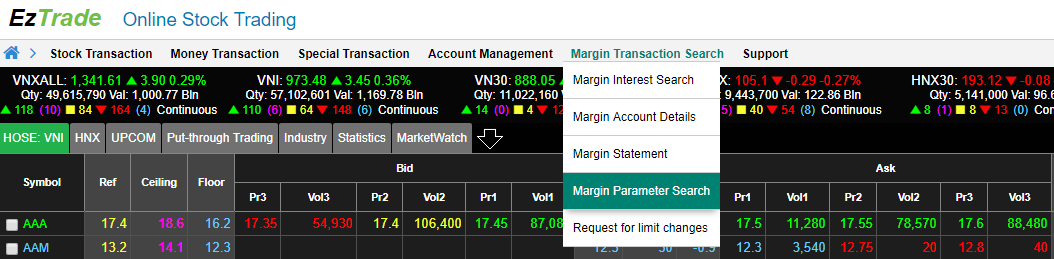

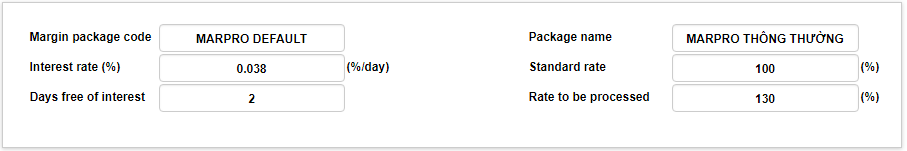

3.4. Margin parameter search

- To look up margin loans, please navigate to “Margin Transaction Search” tab and then click “Margin Parameter Search” item.

- The screen will display information about parameters of the margin package.

4. Some formulas and notes

4.1. Buying power

4.1.1 Basic buying power

- Basic buying power is the buying power of an account before you place a buying order.

- Formula:

|

Basic buying = power |

Cash available + Cash pending for payment + Buying power leveraged by securities - (Debt outstanding + EzMargin Pro cumulative interest) - Cash suspended for buying in the session |

Wherein:

- Cash: Available cash of the customer

- Cash pending for payment: Proceeds pending for settlement of the customer (advance fee withheld)

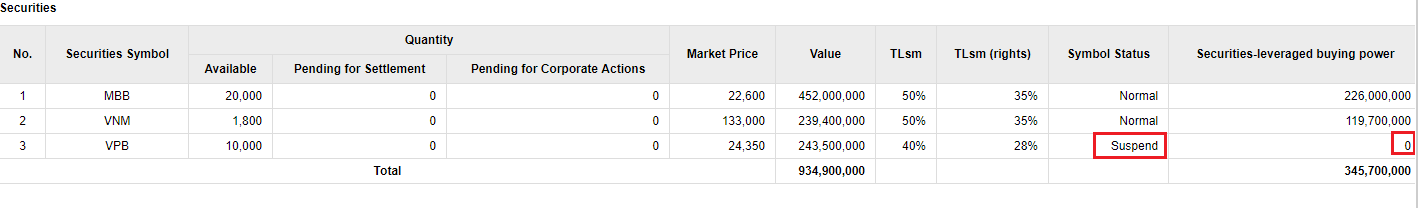

- Buying power leveraged by securities: Leveraged securities value

- Outstanding debt: The amount of money FPTS lent to the customer.

- EzMargin Pro cumulative interest: The EzMargin Pro interest accumulated by day, counted from the last interest payment date.

- Cash suspended for buying in the session: The money is suspended (from basic buying power) for buying shares.

4.1.2 Integrated buying power

- Integrated buying power is a buying power integrated with the leveraged value of stock in the buying order. Integrated buying power will appear on the trading window when customers enter the symbol of securities they want to buy. If the selected stock is not in the Margin Pro list, its integrated buying power will be equal to the basic buying power.

- Formula: Integrated buying power = Basic buying power/ (1 - Lending ratio of securities)

4.2 Loan interest

- Lending interest rate is calculated by day, decided by FPTS from time to time. In case the interest rate is changed, it shall be immediately applicable to all existing margin loans at the time of change.

- Loan interest, calculated on a daily basis (including public holidays, Saturdays and Sundays), is calculated on the basis of actual margin outstanding and daily interest rate.

Loan interest = End of day deposit balance * Lending interest rate

- Loan interest period: From the 25th day of the previous month to the end of 24th day of the current month.

- The interest payment date is the 25th day of every month or the next working day if the 25th day is a holiday, Saturday and Sunday. On the payment date, interest will be converted into a loan and added to the outstanding loan balance.

4.3 Account loan ratio

- You need to know how to calculate, handling levels and additional margin requirements of your margin account to have timely solutions.

- You can refer to the loan ratio (R) calculation methodology, handling levels, additional margin obligations from the General Terms of Margin Trading Leveraged by Buying Power.

4.4 Suspending lending to a stock symbol in the Eligible Margin List

- Description: When a stock reaches the limit specified by the SSC, FPTS will suspend lending for that stock. For example, the number of securities on loan exceeds 5% of listed securities or the outstanding loan for a stock exceeds 10% of FPTS’s equity capital.

- When a stock is suspended from loan, the entire value of that stock will not be included in buying power when you perform trading. However, this does not affect your loan ratio (R).

4.5 Request for stopping EzMargin Pro Service

- To stop EzMargin Pro Service, you need to:

- Sign on the Information Change Form to request the termination of EzMargin Pro Service

- Have sufficient cash in your account to pay up the loan principal and interest.

- Steps:

- You need to go to FPTS Head Office, Branches and Transaction Offices to sign on the Information Change Form (Making request via telephone is not allowed for this option)

- FPTS will collect loan principal and all payable interests and terminate the EzMargin Pro Service for you.