1. Register to Intraday buying power service (SMTN)

* For Customers using Eztrade:

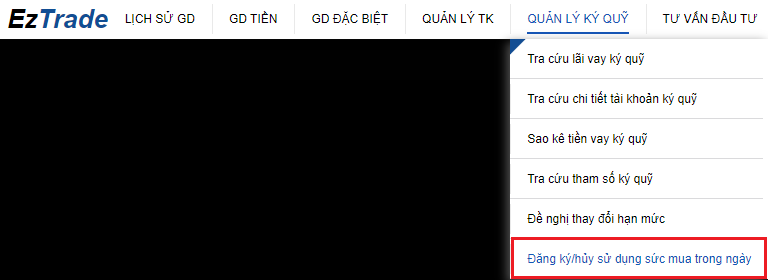

Step 1: After logging into your trading account, Customer selects Margin management/Register/Cancel Intraday buying power

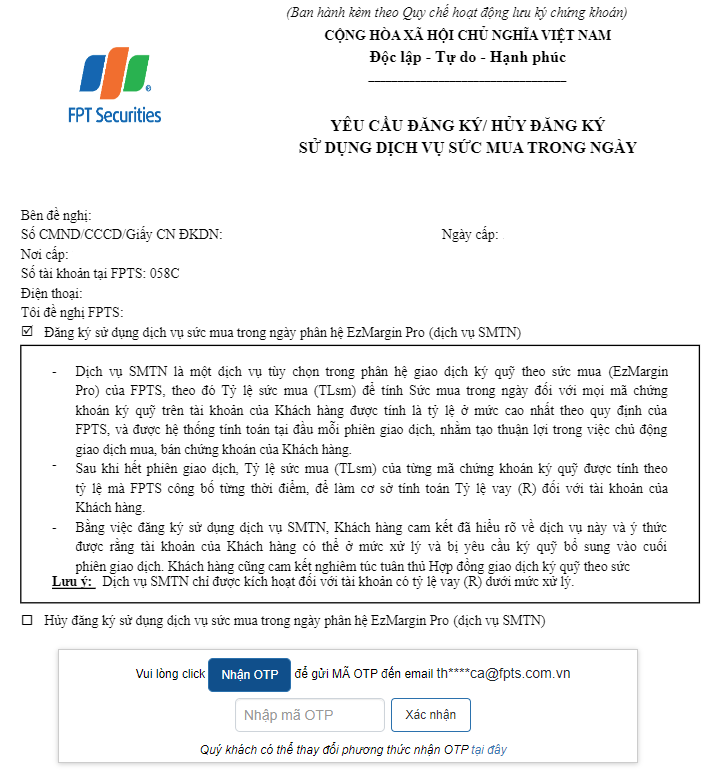

Step 2: Customer confirms by the registered method (Email/SMS OTP/Smart OTP)

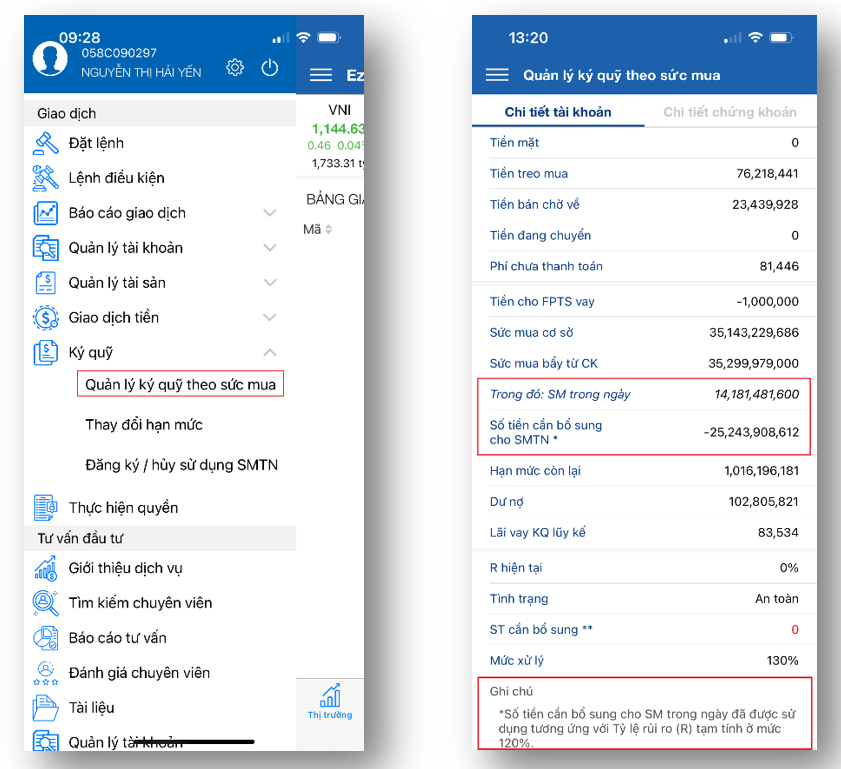

* For Customers using EzMobileTrading:

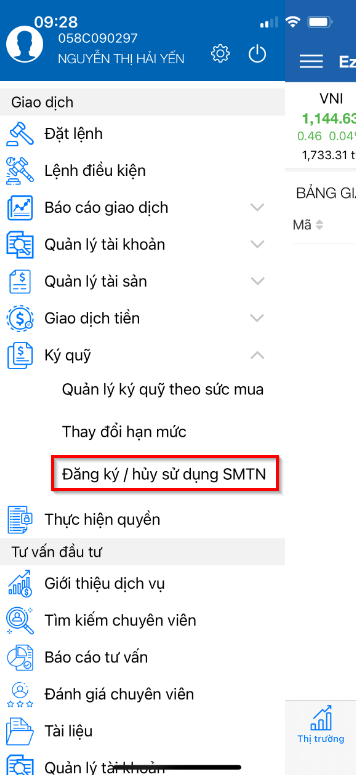

Step 1: After logging into your trading account, at Menu tab, Customer selects Margin/Register/Cancel SMTN then confirms by the registered method.

The Customer’s registration to use SMTP service will take effect in the following trading session.

Example for using SMTN service

- At the end of day T: Customer’s portfolio as follows:

|

Ticker |

Common stock |

Pending stock |

Settlement price |

TLsm (%) |

TLsm of rights

|

Leveraged from stocks in the account

|

|

ACB |

2,000 |

0 |

20,000 |

50 |

35 |

20,000,000 |

|

HDM |

5,000 |

0 |

30,000 |

0 |

0 |

0 |

|

OCB |

10,000 |

5,000 |

15,000 |

40 |

28 |

81,000,000 |

|

TCH |

5,000 |

0 |

10,000 |

20 |

14 |

10,000,000 |

|

Total |

111,000,000 |

|||||

- If Customers register the Intraday Buying Power Service, the margin loan rate of Customers will be the highest rate according to FPTS regulations (currently 50%) for the stocks being loaned

At that time, the leveraged from stocks in the account such as ACB, OCB and TCH will be calculated at a rate of 50% (including common stocks and pending rights) as follows:

|

Ticker |

Common stock |

Pending stock |

Settlement price |

Intraday TLsm (%) |

Buying power from stocks (after update) |

Change in buying power |

|

ACB |

2,000 |

0 |

20,000 |

50 |

20,000,000 |

0 |

|

HDM |

5,000 |

0 |

30,000 |

0 |

0 |

0 |

|

OCB |

10,000 |

5,000 |

15,000 |

50 |

112,500,000 |

31,500,000 |

|

TCH |

5,000 |

0 |

10,000 |

50 |

25,000,000 |

15,000,000 |

|

Total |

157,500,000 |

46,500,000 |

||||

The leveraged from stocks in the account of Customers will increase by 46,500,000 -> This is the Intraday buying power

- SMTN is added to the leveraged from stocks in the account and is updated just once at the time the market opens for the next trading session

- SMTN is only for buying stocks (withdrawing/transferring money is not accepted)

- Orders will only be calculated at the standard TLV

- In case, the account has negative underlying buying power, increasing SMTN will offset the negative percentage that resulted in less SMTN being utilized

2. Look up Intraday Buying Power

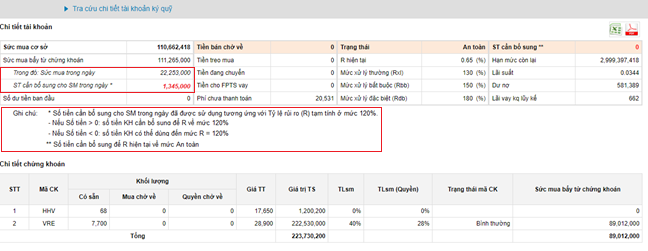

Customers may easily manage risks and look up details of Intraday buying power and the account status:

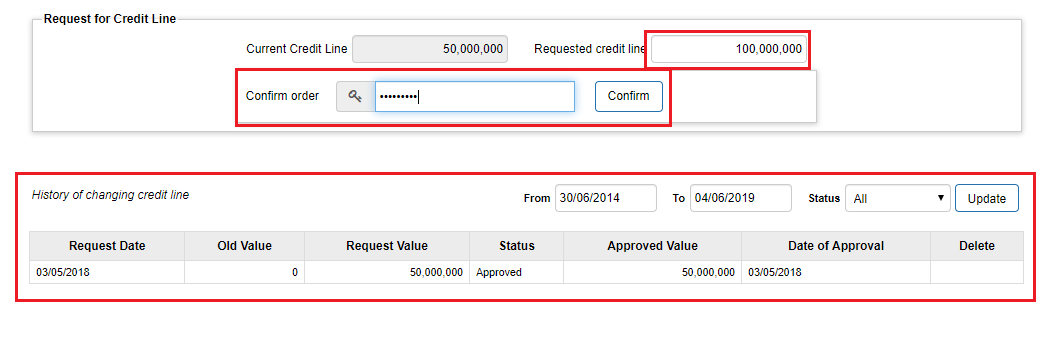

- At EzTrade: Customer select Margin management/Look up details of margin account

- At EzMobileTrading: Customer looks up at Menu tab Margin/Margin management on buying power

Notes:

- The amount to add to Intraday buying power: The amount to add to the Intraday buying power that has been used corresponds to the Risk rate (R) temporarily calculated at 120%.

- If this amount > 0, the amount Customer need to add to bring R to 120%

- If this amount < 0, the amount Customers may use is up to R = 120%

- In case the amount to be added to SMTN > 0, if Customer does not sell stocks/pay money for that amount, after FPTS runs its system, the rate R of the account will be updated according to the normal loan rate -> the account status will be at processing status and the Marpro account will be processed according to regulations.

3. Cancel Intraday buying power service:

Customers may cancel SMTN service at registration screen, following the instructions in Section 1. The cancellation will take effect in the following trading session.

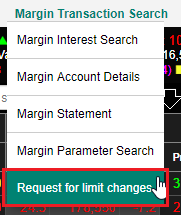

In case the room of margin loan is almost full and customers have the demand for more room, please do the following steps to apply for a new margin loan ratio:

Navigate Margin Trading Search tab and then Request for Limit Change item

Enter the desired credit line limit. Enter the trading password and click Confirm to send the request to FPTS. Customers can track the status and allowed ratios ratified by FPTS on the History item.

FPTS will consider the request and approve of the request if qualified, specifically for each customer.

Note: Margin limit and interest rate may be changed from time to time by FPTS. In case the interest rate is changed, it shall be immediately applicable to all existing margin loans at the time of change. Notably, the margin loan ratio increases when stock prices fall sharply. FPTS shall adjust margin loan ratios of some stocks.

In EzTrade, select Margin Transaction Search

.png)