HOTLINE : 1900 6446

Share Offering Advisory

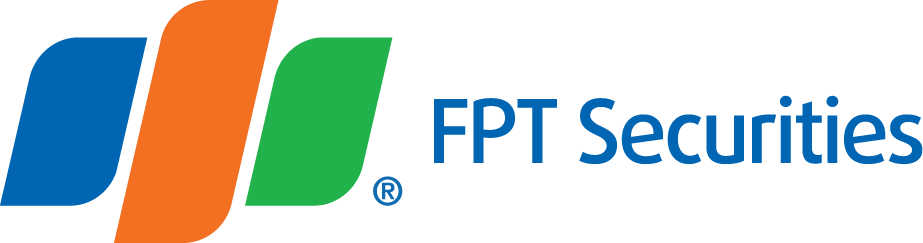

Public Share Offering Advisory

The Public Share Offering Advisory of FPTS helps customer companies increase the scale of operating capital through the offering of shares to the public and FPTS takes the role of accompanying them in issuing and offering shares to the public and bring their business value to the market value.

I. Advisory solution

- Conducting legal and financial due diligence

- Reviewing public share offering conditions for customers;

- Advising on legal issues relating to the chosen issuance plan;

- Advising on the share issuance plan to be submitted to the General Meeting of Shareholders for approval

- Supporting answers to questions about the issuance plan raised by shareholders at the Meeting;

- Compiling and submitting application forms for permission to issue and offer shares to the public

- Compiling documents necessary to seek permission from the State Securities Commission for the share issuance plan (including the prospectus and other documents required by the Commission);

- Working on behalf of customers with the State Securities Commission on approval of the registered share issuance.

- Advising on information disclosure according to the law

II. Service process

* For any further support, please contact the Corporate Finance Advisory Department

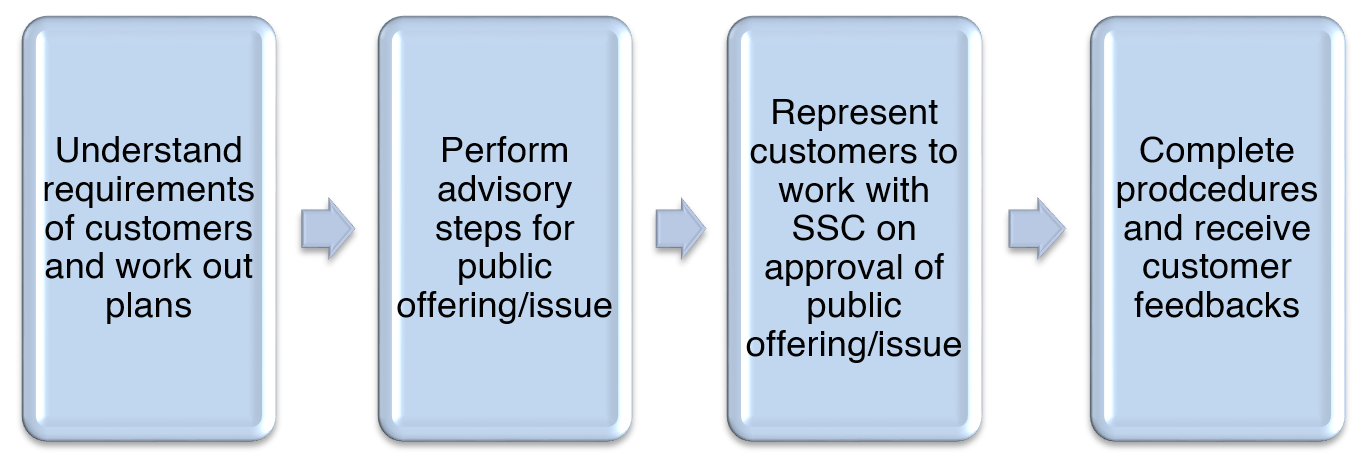

Private Placement Advisory

Private Placement Advisory Service of FPTS helps customer companies pick up best fundraising solutions that match their business plans and assists them to effectively carry out the chosen solutions to deliver optimal outcomes.

I. Advisory solution

- Conducting legal and financial due diligence

- Reviewing private placement conditions for customers; advising on legal issues relating to the chosen issuance plan;

- Advising on the share issuance plan to be submitted to the General Meeting of Shareholders for approval

- Supporting answers to questions about the issuance plan raised by shareholders at the Meeting;

- Compiling and submitting documents for private placement

- Compiling documents necessary to seek permission from the State Securities Commission for the share issuance plan

- Working on behalf of customers with the State Securities Commission on approval of the issuance registration documents;

- Carrying our private placement procedures

- Supporting customers to distribute the issued shares

- Advising on information disclosure under the law.

II. Service process

* For any further support, please contact the Corporate Finance Advisory Department

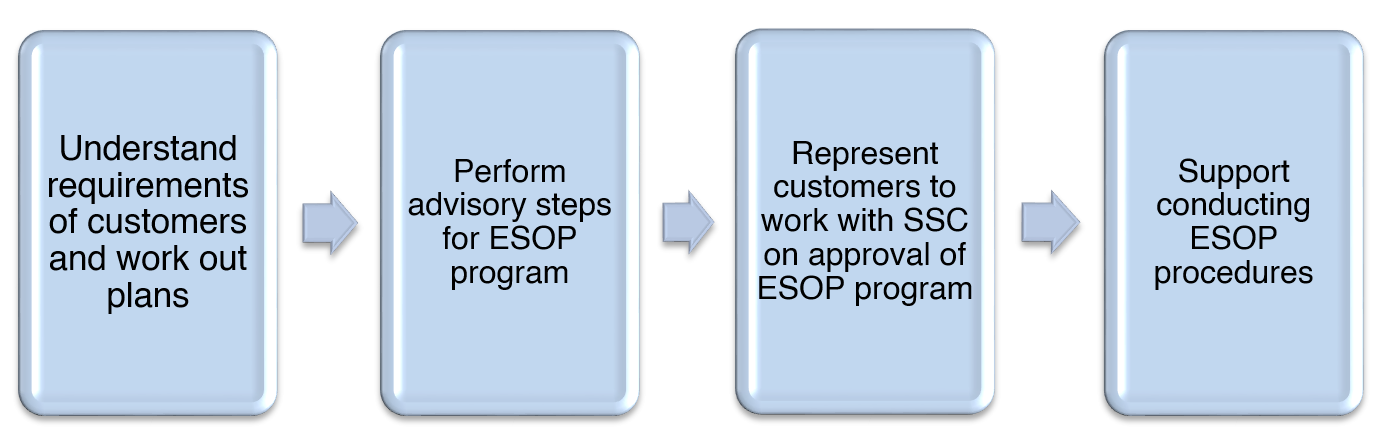

ESOP Advisory

Employee stock ownership plan (ESOP) is a type of bonus for employees to keep their loyalty and devotion to the company. The ESOP program is often based on work performance through such indicators as revenue and profit. In the long term, it will help the company grow faster and stronger. Understanding the importance of ESOP to every company, FPTS provides ESOP Advisory Service to meet this urgent but practical need of customer companies.

I. Advisory solution

- Conducting legal and financial due diligence

- Reviewing ESOP conditions for customers; advising on legal issues relating to the chosen issuance plan;

- Advising on the share issuance plan to be submitted to the General Meeting of Shareholders for approval

- Supporting answers to questions about the issuance plan raised by shareholders at the Meeting;

- Compiling and submitting documents for ESOP

- Compiling documents necessary to seek permission from the State Securities Commission (SSC) for the share issuance plan, including ESOP regulations and other documents required by SSC

- Working on behalf of customers with the SSC on approval of the issuance registration documents;

- Carrying our ESOP procedures

- Supporting customers to distribute the issued shares

- Advising on information disclosure under the law.

II. Service process

* For any further support, please contact the Corporate Finance Advisory Department