HOTLINE : 1900 6446

Equitization Advisory

Equitization Advisory

The Equitization Advisory Service of FPTS covers all matters concerning operating model transformation, helping customer companies achieve highest performance during and after the equitization process in such aspects as operating model, financial performance, reputation and branding.

I. Advisory solution

- Advising pre-equitization issues

- Instructing customer companies to make an inventory and classification of assets

- Instructing customer companies to compare, verify and classify debts and settle financial issues before determining business valuation for going public;

- Advising equitization plans

- Instructing customer companies to work out business plans for 3-5 years after going public;

- Instructing customer companies to rationalize personnel plans after going public;

- Advising on equitization plans, including the scale of registered capital, best shareholder structure for initial public offering and equity selling methods.

- Advising on completion of equitization plans documents to submit to competent authorities for approval;

- Advising on drafting the corporate charter as a joint stock company;

- Advising on post-equitization business improvement

- Advising on the launch of initial public offering (IPO):

- Preparing equity offering documents (Prospectus, bidding regulations; auction notices);

- Providing supports for shares sold via public auction

- Instructing customer companies on lawful transformation into a joint stock company, including organizing shareholders' meetings; conducting business registration; and handing over and making a debut as a joint stock company.

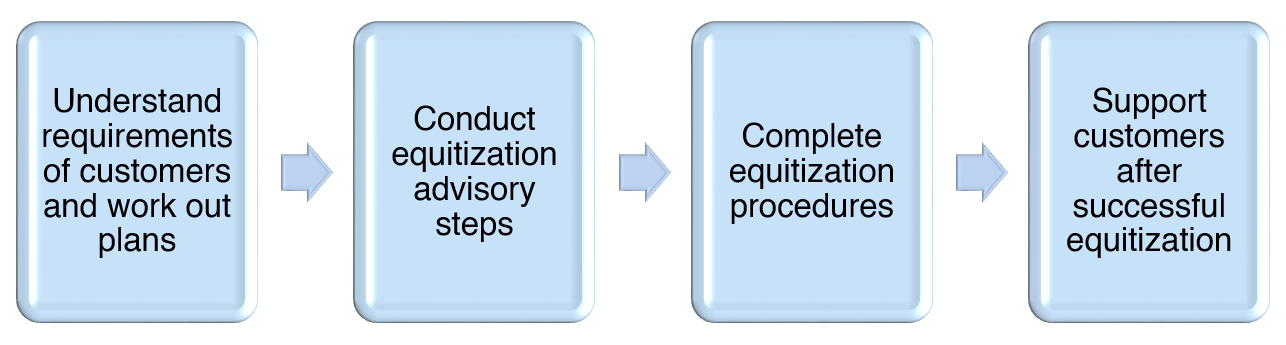

II. Service process

* For any further support, please contact the Corporate Finance Advisory Department